Welcome to RightsRadio.com. I’m Dr. Joyce Starr, and my guest is our resident expert on auto financing/auto loans, Dora Lee Stallard. Dora Lee is on a mission. “Our auto financing program gives me a chance to reach out to people – to help people feel good about themselves. It’s almost like a ministry.” Based in Indiana, Dora Lee Stallard is an “angel” auto financing coach for consumers across the nation. Show Date: September 16, 2010.

Listen to the program – enjoy the highlights below.

Good news on auto financing.

Q: How has the economy has affected auto financing in general – particularly the accelerating numbers of foreclosures. Are auto lenders tightening their belts – especially for those who filed for bankruptcy or went through foreclosure?

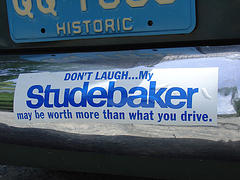

Pre-Owned and Proud of It

A: Actually no. Financing is available. In fact, I feel that companies in this arena are doing even more to help.

Q: I would have expected you to say just the opposite – that auto financing has tightened up exactly like mortgages.

A: Lenders understand that there’s is a human side to this. They have to get up and go to work every day themselves. People have the option to buy a house, but may have no choice regarding a car.

Q: What about rates?

A: Rates vary state to state. They’re set by auto finance committees.

Q: What are the prospects for auto financing if someone filed for bankruptcy?

A: People often surrender their vehicle during bankruptcy because they’re upside down on their car. But they still need transportation to get to their job. Banks and lenders who specialize in auto financing want to know if the person (or couple) was prompt in paying car payments, if they previously paid the minimum due monthly and if they’ve done their homework before seeking another vehicle.

Q: What homework must they do?

A: First, you should understand what’s available in your state. You should identify dealerships in your area that are able to help you. You can’t get into an auto loan without putting money down. Be prepared to put down between $500 and $2500.

Q: What if they don’t have it?

A: If even $500 is almost impossible, lenders will work with me. But you may not get the SUV that your heart desires. Be realistic. I’ve had consumers wait months to come up with the $500.

Q: Please describe your program.

A: My particular program is pre-owned vehicles. The lenders want to see a vehicle that is mechanically sound. You must have proof of income – at least six months of bank statements for those who are self-employed. Never give your credit info over the phone. Go in and meet the person who is working with you. Try vehicles on for size. Find one that fits your budget.

To learn more, see DoraLee’s new Fresh Start Indy Guide on Amazon! The Guide includes a vital auto finance planner.