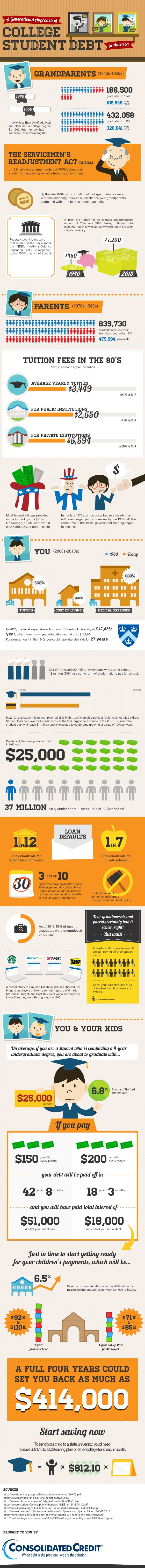

College students today are spending more on their education than ever before. Here’s a visual look at the numbers.

Guest post and image by graphic artist Maxine Wells (Gryffin.com).

Tuition has risen 500% since 1985 and continues to rise each year, making it increasingly difficult to afford college. While a large percentage of full-time students take on a part-time jobs, the extra money does not cover tuition, books and other necessities.

With a reduction in grants and scholarships, student loans are often the only alternative. Although college grads earn significantly more than those without degrees, our sluggish job market could leave them unemployed for months or even years to come. Many could be paying off loans well into their 30s and 40s. The following graphic demonstrates what a college degree might cost you, along with the history of student loan debt. Special thanks to Consolidated Credit for allowing me to share it.